The short positions I opened today (10/02) are: OII ($30.26 : -0.55%), JOYG ($36.86 : +0.96%), TTI ($23.82 : +3.2%). We'll see how these develop soon enough...

Bad News: lost ~2% on both OSI and CEI which leads me to a new idea of not entering long positions on 3 letter stocks that end in I. I'm pretty sure that will keep me out of trouble in the future ;-). OSI faked me out and CEI had great Institutional buy-in interest, but the price just wouldn't budge up. It dropped low enough today to trigger my entry stop-loss and well, I'm out of the trade. At this point CEI looks like it's not going anywhere for a little while anyway.

Good News: gained enough on LNC, T, NAV and AMAT to be net positive, even after those drawdowns. Of course GM should contribute to that net positive when I'm ready to close it out. Isn't that how trading is supposed to work?

I've been predicting doom & gloom for the markets for the past 3 trading days. Well, maybe not doom & gloom, but it seemed like the market was due for a pullback. If you read my blog last week you'd know that I was a couple days early to the punch. As expected, the markets have seen a correction for the last couple days, but I'm not underestimating the bulls optimism as they've been pushing the market up until the bears finally held their ground on Friday and exerted some downward pressure today. There is a great deal of market optimism, but it seems to be a bit too shallow to support the last buying frenzy.

I've been keeping a keen eye for good bearish trades and had a plethora to choose from last night. I saw about a dozen Reward:Risk ratios of > 3:1 in my bears watchlist last night and cut it down to 5 that I flipped a coin on and decided to attempt entry today. As described earlier, 3 filled (the two that didn't were CMC &GGB, I'll reevaluate those two tonight). Two that I didn't attempt entry on, but made a very nice move down today are: HES and HP.

This post is titled Market Study for today so let's go on with the show, shall we?

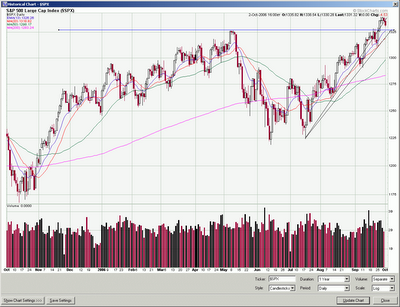

The S&P 500 seems straight-forward enough, it looks likely to pullback to near the previous high or at least consolidate near it's closing value today.

The Dow-Jones Industrial Average seems to have been a bit more practical in it's last swing high, but still looks like it could close below it's previous high for the next couple days.

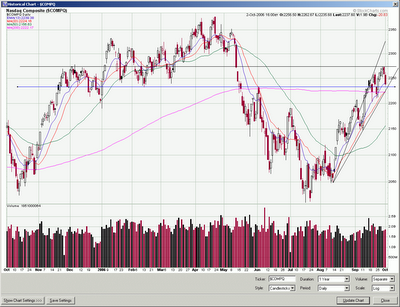

Everybody loves the NASDAQ right? There's plenty of optimism and fresh money that can be thrown into technology stocks to drive the NASDAQ up. Why do I say this? CNBC watchers have been told that money is being pulled out of energy stocks and is being put into the technology stocks. Of course that begs the question: are people so easily herded? Possibly, but of course, like any entity forecasting market direction, it's done with the other side presenting an equally convoluted case for why the market could likely go the other way. It's a fun game of semantics and opinion. So rather than speculating based on sentiment, let's read the story that the price-action (aka: mass-psychology) is telling. Considering the previous price-action that I've highlighted, we could certainly see some consolidation and volatility as it stumbles it's way up.

As always, form your own opinions and have a good laugh at me for sticking my neck out there and actually favoring a direction. Please remember that I'm an aspiring professional and I still consider my technical analysis skills in their infancy. I think we're in for some volatility more than direction for a while which is pretty good news for playing both sides of the market at the same time, although that does mean that you can get burned either way, right?

Thank you for your continued interest in my blog! Don't take what I write too seriously, I've been wrong before and I'll be wrong again!

No comments:

Post a Comment