In the spirit of Thanksgiving I want to thank you for your continued interest and support. I have some wonderful readers; your comments recently have really lifted my spirits. Combined with a rejuvenating visit with my family for Turkey, now that the Tryptophan has worn off a bit, I'm feeling great. I've quietly been getting my way back into the markets this week, maintaining my watchlists and looking for setups to put my plan into action. I just need to get back into the practice of writing things up for your reading pleasure.

I began this post last night, hence the title, and was going to make a smart remark about whether or not the markets would see the same black balance as retailers today or if they’d be marked down to red tag sale prices. The new questions are now: will today’s shortened and lightly traded day see a follow-thru day in the red on Monday? Will traders and investors go on another buying binge, or will they need to close some positions to pay for the door buster deals they bought this morning? The trend does not seem to be in Jeopardy, so I don’t have to state my answer in the form of a question, but hey I've already gone this far: What is profit-taking? Alex? Judges?

Before I go further with the Jeopardy parody, let’s take a look at the (paper) trades I opened this morning: GT $17.89, ACN $34.32, AGR $17.86, and BAC $54.56. As I’m sure you recall, my goal is 25 flawless trades with 10 in a row before I go back to live, real money trades. I’m off to a pretty good start; however I need to refine one aspect in order to have a clearer policy on managing entry on a stock that gaps down. I watched these develop during the first couple hours at market open and decided to make entry based on the 5 minute intra-day chart. I haven’t nailed down my exact trading policy for such entries, and will review the materials, knowledge base and TMTT resources in order to nail down this gray area of my trading plan.

Thursday, November 23, 2006

Thursday, November 16, 2006

Feeling Pavlovian

Dear readers, as you know I've been having a difficult time of things lately. I haven't been secretive about it, but I have been keeping the full magnitude of the recent events out of my blog. I've been in a period of introspection. I do try to bring you the unvarnished truth behind my personal journey here, not only for you to understand what Teach Me To Trade/EduTrades teaches, but also for you to understand my perspective of the journey to becoming a professional trader. I'm attempting to bring you the trials, tribulations, joys, sorrows, successes, failures, mental & emotional adjustments to name a few. So it would be wrong of me to withhold the negative experiences along the way, wouldn't it?

Of course I want to be able to report all the things I'm proud of here, all the happy news of my successes, and no, I don't enjoy bringing bad news to you. I'm sure there will be better news to report to you in the future, the near future, certainly, but you must know just how trying the last few weeks have been on me personally. Not everything is directly related to the market and my pursuit of becoming a professional trader, but since putting in the time takes away from other activities that I'd like to partake in, the personal aspects are inextricably linked. I consider the time spent trading as a short-term sacrifice for a long-term goal. As I become able to live off of my trading profits time will become less of an issue considering that I won't need to devide it up between 2 jobs. It's an investment, but this time commitment has created a terribly difficult strain on me personally.

As you know from reading previous posts, I finally became ill about a month ago. The time burden of the schedule was certainly a large contributing factor. This then led from one thing to another, including a break-up with a girl that I loved very dearly. Yes, even though that relationship started a mere couple months back I really loved her. Why does that break-up have anything to do with the Trading? Simply put, I created a situation that she could not have in her life because of my commitment to trading. I put the market and trading ahead of her and her interests (at least in the short-term) and I don't blame her for deciding to end things based on that. Now, that is a much simplified version of how things ended, but it's at the core.

You must also understand that my actions were actually a consideration of the future with her and that I wanted to be a successful trader in order to provide for both of us. It stung even more to have the market destroy the relationship I was hoping to provide for via the market. So the very actions I was taking for the long-term destroyed part of the reason I wanted to be a success. Is it odd to link the two together? Maybe, but it's the truth of the matter for me personally. Call me traditional, but I still hold to the ideal that I should be the primary provider in a family and I have a strong desire to be able to provide financially, as I know that I already have much to give personally. It would appear that I prematurely invested too much of my emotions in a future with her. The fact that she was unable to forgive me for the single failure on my part, which is really as simple as an adjustment of priorities, is a clear indication that she's not the right person for me. I can't be held to perfection, that's too much pressure for me, and I already have enough pressure from my own expectations of myself. Not to mention that holding someone to perfection isn't something that a loving partner does. I recognize my shortcomings and failures and strive to do better, but in the end must forgive myself of my faults. I do the same for everyone else on the planet, and especially for those I love. I need the same understanding and forgiveness from a loving partner.

It seems that, at least for the near-term future, romance & relationships are not possible. Between work, music and the time it takes to become a successful trader, I don't have time for such pursuits, not to mention the pain and emotional trauma brought on by this most recent experience.

The worst part is simply the timing of it all. I finally, after several months of diligent study and practice, including time with Coach Rob and Mentor Jordan, enter real money trades and get a series of losers immediately followed by my girlfriend dumping me. Talk about a low point, and of course it's become a Pavlovian response for me to simply avoid the markets for the past couple weeks. Think about it, at the moment, the markets have brought me very little more than pain. Pain financially and emotionally. Rationally and logically I realize that I'm letting my emotions get in the way of my success, and of course that realization makes me feel worse because I want to be able to put all of that aside and just do what I need to do. I will.

I have no change of plans for my future and I am, at my core, a resilient optimist. I will be a successful trader, and these events will simply add to my experience to make me better at what I do. I appreciate your interest in my journey and hope that you continue to find my trading blog interesting and compelling enough to be worth your time. We will get back to our regularly scheduled broadcast after this week. I've been working full time and rehearsing & performing everyday this week, accounting for approximately 15 hours of each day (including the commute time), leaving very little time for anything else.

Of course I want to be able to report all the things I'm proud of here, all the happy news of my successes, and no, I don't enjoy bringing bad news to you. I'm sure there will be better news to report to you in the future, the near future, certainly, but you must know just how trying the last few weeks have been on me personally. Not everything is directly related to the market and my pursuit of becoming a professional trader, but since putting in the time takes away from other activities that I'd like to partake in, the personal aspects are inextricably linked. I consider the time spent trading as a short-term sacrifice for a long-term goal. As I become able to live off of my trading profits time will become less of an issue considering that I won't need to devide it up between 2 jobs. It's an investment, but this time commitment has created a terribly difficult strain on me personally.

As you know from reading previous posts, I finally became ill about a month ago. The time burden of the schedule was certainly a large contributing factor. This then led from one thing to another, including a break-up with a girl that I loved very dearly. Yes, even though that relationship started a mere couple months back I really loved her. Why does that break-up have anything to do with the Trading? Simply put, I created a situation that she could not have in her life because of my commitment to trading. I put the market and trading ahead of her and her interests (at least in the short-term) and I don't blame her for deciding to end things based on that. Now, that is a much simplified version of how things ended, but it's at the core.

You must also understand that my actions were actually a consideration of the future with her and that I wanted to be a successful trader in order to provide for both of us. It stung even more to have the market destroy the relationship I was hoping to provide for via the market. So the very actions I was taking for the long-term destroyed part of the reason I wanted to be a success. Is it odd to link the two together? Maybe, but it's the truth of the matter for me personally. Call me traditional, but I still hold to the ideal that I should be the primary provider in a family and I have a strong desire to be able to provide financially, as I know that I already have much to give personally. It would appear that I prematurely invested too much of my emotions in a future with her. The fact that she was unable to forgive me for the single failure on my part, which is really as simple as an adjustment of priorities, is a clear indication that she's not the right person for me. I can't be held to perfection, that's too much pressure for me, and I already have enough pressure from my own expectations of myself. Not to mention that holding someone to perfection isn't something that a loving partner does. I recognize my shortcomings and failures and strive to do better, but in the end must forgive myself of my faults. I do the same for everyone else on the planet, and especially for those I love. I need the same understanding and forgiveness from a loving partner.

It seems that, at least for the near-term future, romance & relationships are not possible. Between work, music and the time it takes to become a successful trader, I don't have time for such pursuits, not to mention the pain and emotional trauma brought on by this most recent experience.

The worst part is simply the timing of it all. I finally, after several months of diligent study and practice, including time with Coach Rob and Mentor Jordan, enter real money trades and get a series of losers immediately followed by my girlfriend dumping me. Talk about a low point, and of course it's become a Pavlovian response for me to simply avoid the markets for the past couple weeks. Think about it, at the moment, the markets have brought me very little more than pain. Pain financially and emotionally. Rationally and logically I realize that I'm letting my emotions get in the way of my success, and of course that realization makes me feel worse because I want to be able to put all of that aside and just do what I need to do. I will.

I have no change of plans for my future and I am, at my core, a resilient optimist. I will be a successful trader, and these events will simply add to my experience to make me better at what I do. I appreciate your interest in my journey and hope that you continue to find my trading blog interesting and compelling enough to be worth your time. We will get back to our regularly scheduled broadcast after this week. I've been working full time and rehearsing & performing everyday this week, accounting for approximately 15 hours of each day (including the commute time), leaving very little time for anything else.

Friday, November 10, 2006

Re: Thanks for the blog

On 11/9/06, CV wrote:

I hear you loud an clear CV. I have enough trouble keeping my head above water between work, markets & music, and the money spent on training certainly feels like a lot today. I look forward to the day it seems like pennies. The folks at Teach Me To Trade are as dedicated as you are to your success, you really are not alone. Granted, they're not there to suggest trades or advise you on a specific trade. No, they're there for something far more powerful: to teach you to trade in order for you to be able to take control and be a success.

I've needed a break from everything market related for the last couple weeks, and knowing my schedule will put me at a severe time disadvantage for getting back in. I've already learned the lesson to not jump back in after a break (see: Discipline, Patience & Timing). I have rehearsals and performances starting yesterday for 11 days straight. I have much to say and do with the markets and will be posting in updates and clearing out the blog-webs (think cob-webs... I know my blog has been attracting dust & lint lately). I need to find some way to balance it all out... I feel like I binge on one thing and then another, when I really need to find a way to balance out each week (and probably each day).

In other news, I purchased: taotrading.biz (nothing there yet) which I plan to put a discussion board for others that are interested (amongst other pursuits relative to trading). I'm looking forward to having more of an open discussion rather than the one-sided leaning blog.

Thanks for saying hi, I look forward to hearing from you again soon.

Mark

I’m also a TMTT student. As of now we (wife also) just started and completed the master trader on demand and will go next to covered calls. We are also taking a trip to UT in Dec and spend back to back weekends for the master trader and covered calls. We are also reading a lot to try to keep just above water with all the information the academy has. We have a mortgage and 2 kids, so time is in short supply every day. We took the package with 6 classes and extra mentor days (don’t remember but may have been the elite package). We to have signed up for the coaching and additional class and mentor time. We did put a lot of money in, but as for education…they have a ton of stuff to become proficient in trading. Although thinking of the money we let go still gives me a tightening felling in my head and chest; my wife and I have come to a crossroad. We have to be proactive in our future, it’s just a little scary when all you life you grow up thinking that if you just work till you retire (so far it’s 75 they way I’ve calculated it) you will be just fine. I have to consider what I need to do for the future in terms of cash flow, not to mention having 2 kids and how much that will cost in college alone.

I think I’m rambling on so, fell free to contact me. I sit in front of the computer all day long (yes my dreaded J.O.B.). We’ll it’s not really bad here but I really don’t see them planning for MY future as much as they plan it for the executives. So I’m on my own….

Thanks

CV

South San Francisco

I hear you loud an clear CV. I have enough trouble keeping my head above water between work, markets & music, and the money spent on training certainly feels like a lot today. I look forward to the day it seems like pennies. The folks at Teach Me To Trade are as dedicated as you are to your success, you really are not alone. Granted, they're not there to suggest trades or advise you on a specific trade. No, they're there for something far more powerful: to teach you to trade in order for you to be able to take control and be a success.

I've needed a break from everything market related for the last couple weeks, and knowing my schedule will put me at a severe time disadvantage for getting back in. I've already learned the lesson to not jump back in after a break (see: Discipline, Patience & Timing). I have rehearsals and performances starting yesterday for 11 days straight. I have much to say and do with the markets and will be posting in updates and clearing out the blog-webs (think cob-webs... I know my blog has been attracting dust & lint lately). I need to find some way to balance it all out... I feel like I binge on one thing and then another, when I really need to find a way to balance out each week (and probably each day).

In other news, I purchased: taotrading.biz (nothing there yet) which I plan to put a discussion board for others that are interested (amongst other pursuits relative to trading). I'm looking forward to having more of an open discussion rather than the one-sided leaning blog.

Thanks for saying hi, I look forward to hearing from you again soon.

Mark

Tuesday, November 07, 2006

Moving to TradeStation, too

Hi Mark,

Sorry to read about your tribulations. Hang in there.

I went to my mentor last week. Sam showed me Fibonacci and gap strategies. He showed me several stocks he thought would go down and a few bullish ones. I played several. I didn't play CMI (coulda made a bundle) and I did play GS and MRO. So far, they don't look good, especially after today's rally. I'm ahead in more spreads than I am behind in but GS and MRO have me in the red.

...

I sent a check to Interactive Brokers a day before I saw your post about TradeStation. I looked at the TS web site and liked it. IB returned my check because it had my old address. I felt so happy about the returned check that I knew I really wanted to try TS. Did you know there are third party plug-ins that you can use to automate your trading? All I would need is a computer and a Doberman. I would feed the dog and the dog would keep me from touching the computer. Anyway, I'll fund the account after my options expire on 11/17, if I have any cash left. -- GG

He who has injured thee was either stronger or weaker than thee.

If weaker, spare him; if stronger, spare thyself. --Seneca

GG, thank you for your support. I'm making a comeback from the recent emotional and trading lows. I just needed a little time to mourn. I can't afford any more mourning, so it's time to move on. That's over and aside from having an over-extended schedule, I'll be back in the markets soon enough (later this week for paper trading at least).

It seems like we'll be on the same timeline for funding our TradeStation accounts. I'm looking to TS to leverage my time a bit better. From my understanding you can program in automatic trading without 3rd party tools by simply using EasyLanguage. As a programmer, this should be fairly natural for me to write out my trading rules and then I won't mis-manage nor micro-manage my trades.

Of course the thought comes to mind that there is no "black-box" trading system that will work, which puzzles me a little, I must say. Since, logically, if you are strictly trading by your rules, you are essentially being your own black-box system. I imagine my entry rules will be pretty simple, but my exit rules will be a bit more interesting when I get around to programming them into TradeStation. It's all very interesting and I don't know exactly what to make of it. I'm most certainly going to be more involved in choosing which trades to enter, but even that will be honed down to a strict set of explicit rules that should be able to be described in TradeStation's EasyLanguage. It's a head-scratcher for now.

Aside from EasyLanguage, TradeStation's charts are top-notch and, along with a 22" ViewSonic widescreen display that I recently purchased, ought to save me some time in evaluating any given chart. Yes, that's right, I'm beginning my equipment upgrades with a rather large second flat-panel display. Eventually I'm sure I'll have about 4 or more displays working for me, but 2 will have to do for now.

Mark

Tuesday, October 31, 2006

Tough Times

Hi all. There are a number of things going wrong in my personal, professional and trading life at the moment. Much of it is related to the aftermath of the illness I suffered from a couple weeks ago. I've been falling behind on pretty much everything and on a highly personal note, my heart has been broken.

This blog is not about such matters, but please bear with me while I regroup. I have already written up the blog postings about my time with Mentor Jordan and the final call from Coach Rob, so come back soon. I should publish them tonight after I review for content, spelling & grammar.

This blog is not about such matters, but please bear with me while I regroup. I have already written up the blog postings about my time with Mentor Jordan and the final call from Coach Rob, so come back soon. I should publish them tonight after I review for content, spelling & grammar.

Wednesday, October 25, 2006

Back to the Drawing Board

Although this week's trading has been better, I've been making mistakes and they're costing me money. I still have 4 open positions (long on USB, UARM, CVA and short on FDG) that could earn some money to offset the losses, but if you looked at my trading journal you'd think that I was addicted to giving the market my money. Granted, the bulk of the losses came last week primarily from bad entry strategy, but I'm still seeing flaws in the entry and management of my trades, so it's time I take a step back and test my trading rules in the sandbox again. This decision is primarily based on my failure to consistently apply my rules, not because I've incurred losses on the trades. Losses on trades are going to happen, but without consistently, flawlessly applying my trading rules, I have no way to know how successful my rules are and therefore I don't know how to systematically improve my results. The reason behind my failure to do so is because my trading rules are not explicit enough; they have too much gray area that's open to interpretation which makes it difficult to apply them. It's disappointing and I know you, my father and everyone who has helped me along the way are all interested in hearing of great success from me, but such is the current status of things. I'm implementing the following plan of action to get me back into live trades:

- Finish my business plan.

- Includes my very specific, explicit trading rules. These are an adaptation of both Coach Rob's and Mentor Jordan teachings & thoughts on trading. It's an amalgamation of the two that I find appropriate for my risk tolerance, and burgeoning trading style.

- Trade 25 flawless paper trades with 10 in a row flawless before going back to real money.

- Flawless only means I don't make any mistakes according to my trading rules.

- I will evaluate my rules after 25 trades to see what rule changes could net me a better return.

- If, after 25 flawless paper trades, I'm not seeing a net positive, I will apply some changes to my rules and retest on the next block of 25 trades and will repeat the process until I'm getting a net positive result.

- Set up an account with TradeStation.

- TradeStation comes with very sophisticated tools for programming and evaluating rule-based trading including back-testing a strategy against up to 20 years of intra-day historical market data. I'm looking to TradeStation instead of Interactive Brokers because of these advanced features which should help with consistency and aid in reducing the time trading will require, making it more scalable and manageable on my time budget. I'm deciding to take this action now because it's the direction I'm planing to go, and while I'm tabling my money I may as well make the transition concurrently. TradeStation has great appeal to me because I'm a programmer and this sort of logical evaluation of a trade strategy based on my custom rules is pretty much a fantasy come true.

Saturday, October 21, 2006

Real Trades Week 1

Yes, there are some posts that I owe you, but I thought you might be interested in how trading went my first week. In short: Ouch! I entered and exited 6 straight losers! Yes, you heard that right, after all the practice, all the effort you know I put in, last week cost me some money.

Bad news, I know; trust me, I felt that. I have found that most of the trades could have been avoided, but they weren't an embarrassment, they just were less than ideal. I entered pretty much all of these on the day of using an hourly intraday chart. It's a good tactic to reduce risk & increase reward, but I was getting better trades from the more pure daily entry model so I'm going to be a bit more judicious when entering these sorts of positions on the intraday. It's not as if I was chasing these stocks, the entry wasn't bad, the setups weren't bad (save for a couple described below), but the trades, never-the-less did not work for me.

It's an odds based business and there's no reason to micro-manage each individual trade. These hurt, but they're part of the game. So I'm feeling slightly discouraged today, but that's no reason to abandon my trading plan, nor ignore or deny the skills I've been working so hard to acquire over the past 5 months. I am looking forward to breaking this perfect streak next week.

Here's the quick list of what happened:

Stock, Long/Short, Entry Date, Entry Price, Exit Date, Exit Price, Comments

Yes, you're right, I'm going to have to learn how to be brief if I'm going to have time for this blog!

Bad news, I know; trust me, I felt that. I have found that most of the trades could have been avoided, but they weren't an embarrassment, they just were less than ideal. I entered pretty much all of these on the day of using an hourly intraday chart. It's a good tactic to reduce risk & increase reward, but I was getting better trades from the more pure daily entry model so I'm going to be a bit more judicious when entering these sorts of positions on the intraday. It's not as if I was chasing these stocks, the entry wasn't bad, the setups weren't bad (save for a couple described below), but the trades, never-the-less did not work for me.

It's an odds based business and there's no reason to micro-manage each individual trade. These hurt, but they're part of the game. So I'm feeling slightly discouraged today, but that's no reason to abandon my trading plan, nor ignore or deny the skills I've been working so hard to acquire over the past 5 months. I am looking forward to breaking this perfect streak next week.

Here's the quick list of what happened:

Stock, Long/Short, Entry Date, Entry Price, Exit Date, Exit Price, Comments

- NYX, L, 10/17, $74.01, 10/17, $73.12, This could have been avoided by waiting for upward movement. There was a gap up, in the desired direction, but that's not a good reason to jump in. I now have a rule to wait for a Higher Swing Low if I see a similar gap. This could have been avoided based on this simple rule.

- PEG, S, 10/17, $60.70, 10/18, $60.98, Put in a Lower Swing High, and I jumped in on the intraday (hourly) and initially it looked good. Here's where the daily entry would have kept me out of this loss.

- UNT, S, 10/18, $45.19, 10/19, $45.80, Jumped in on another Lower Swing High on the intraday (hourly) but it faked me out and found support where it found it before.

- GRP, S, 10/18, $37.33, 10/19, $38.14, Entry was another intraday Lower Swing High (hourly), which initially looked good. Honestly this wasn't a bad entry, but I don't particularly like the range of the trading days relative to the direction. Looking at it now makes me think: I don't like the way this chart is looking at me.

- LYO, L, 10/19, $26.08, 10/19, $25.94, Took the gap down entry, which initially looked brilliant, but very soon after fell enough to trigger my stop. Not a bad idea, just didn't go this time. Good news is the stop kept me from losing more as it's still trading lower today.

- ABT, S, 10/19, $47.82, 10/19, $47.83, I was looking for entry on the reversal pattern, but didn't see it happen. My entry was aggressive based on the up-gap. Once again, not a bad idea, however being more judicious about the intraday entry, especially on a potentially new direction seems appropriate.

Yes, you're right, I'm going to have to learn how to be brief if I'm going to have time for this blog!

Wednesday, October 18, 2006

Sick!

Ack... cough... sputter... I've got a cold that's really beginning to hurt... I have much to tell you so come back soon for my account of my 2 days with Mentor Jordan Stokes and the final wrap up call from Coach Rob Craig. I Promise I will post when I've got the time & energy, but for tonight I'm going to run my scans and manage my positions. I'm trading real money now, watch out!

Thursday, October 12, 2006

A Lesson in Liquidity & Execution

I have to share this with you. If you've been paying attention to my current position updates you knew that I entered a short position on SVN on Monday. You may have also noticed Trader Charlie's question about volume on his comment and read my response to his comment (check out the comments on: Re: Mark I like your BLOG! - Trade Seeker Question...). Good, I'm glad you're paying attention.

Aside the scant volume SVN sees, I followed my trading rules. I got stopped out today and bought back the short sale (sold for $6.73 on 10/9) for $6.708. You must be wondering why I'm excited about getting a mere 0.18% gain (after Cost of Trade). Take a look at this single-day 2-minute interval chart on SVN for today:

The black line is where my stop was located at $6.70 (3 cents better than break-even). And, yes I could have been justified in lowering my stop a couple more pennies based on this intraday chart and bailed once it violated the previous high after all that consolidation/no movement. I actually put some limit orders in to scale out of the position yesterday and today, but I was a little too optimistic and set the price too low to execute. There's a ton of what-ifs. I chose to set my stop at $6.70 and was waiting until I saw today's closing price to adjust from there. Anyway, let's move on...

The black line is where my stop was located at $6.70 (3 cents better than break-even). And, yes I could have been justified in lowering my stop a couple more pennies based on this intraday chart and bailed once it violated the previous high after all that consolidation/no movement. I actually put some limit orders in to scale out of the position yesterday and today, but I was a little too optimistic and set the price too low to execute. There's a ton of what-ifs. I chose to set my stop at $6.70 and was waiting until I saw today's closing price to adjust from there. Anyway, let's move on...

Notice the volume, it is appalling. I did say I may live to regret this trade because of the thin volume. Given the complete lack of volume when the stock crossed the black line (my stop) I was convinced my order would be filled for a loss and I'd be buying back the stock at the blue line for ~$6.80. However, when I pulled up my Interactive Brokers account, I could see that IB filled my order for an average price of $6.708 (it executed across 3 exchanges, one at $6.70, and two at $6.71) which turned what I was certain was a loss into a gain.

Once again, I'm asking myself: What have I learned? ... Liquidity is good, learn to love it and don't be sucked in my a low volume stock just because it has a few higher-volume days under it's belt. Turn up the volume! The other thing I learned is that Interactive Brokers has terrific execution. Any questions?

Aside the scant volume SVN sees, I followed my trading rules. I got stopped out today and bought back the short sale (sold for $6.73 on 10/9) for $6.708. You must be wondering why I'm excited about getting a mere 0.18% gain (after Cost of Trade). Take a look at this single-day 2-minute interval chart on SVN for today:

The black line is where my stop was located at $6.70 (3 cents better than break-even). And, yes I could have been justified in lowering my stop a couple more pennies based on this intraday chart and bailed once it violated the previous high after all that consolidation/no movement. I actually put some limit orders in to scale out of the position yesterday and today, but I was a little too optimistic and set the price too low to execute. There's a ton of what-ifs. I chose to set my stop at $6.70 and was waiting until I saw today's closing price to adjust from there. Anyway, let's move on...

The black line is where my stop was located at $6.70 (3 cents better than break-even). And, yes I could have been justified in lowering my stop a couple more pennies based on this intraday chart and bailed once it violated the previous high after all that consolidation/no movement. I actually put some limit orders in to scale out of the position yesterday and today, but I was a little too optimistic and set the price too low to execute. There's a ton of what-ifs. I chose to set my stop at $6.70 and was waiting until I saw today's closing price to adjust from there. Anyway, let's move on...Notice the volume, it is appalling. I did say I may live to regret this trade because of the thin volume. Given the complete lack of volume when the stock crossed the black line (my stop) I was convinced my order would be filled for a loss and I'd be buying back the stock at the blue line for ~$6.80. However, when I pulled up my Interactive Brokers account, I could see that IB filled my order for an average price of $6.708 (it executed across 3 exchanges, one at $6.70, and two at $6.71) which turned what I was certain was a loss into a gain.

Once again, I'm asking myself: What have I learned? ... Liquidity is good, learn to love it and don't be sucked in my a low volume stock just because it has a few higher-volume days under it's belt. Turn up the volume! The other thing I learned is that Interactive Brokers has terrific execution. Any questions?

Labels:

Closed Position,

Execution,

Favorite,

Liquidity,

SVN

Wednesday, October 11, 2006

Stoked About Upcoming Mentoring

Monday & Tuesday of next week will be spent in Las Vegas with my father and TMTT Mentor Jordan Stokes. I'm going to be sitting down with a professional trader, during market hours and let me tell you, I'm getting very excited about it! I'll blog about the experience, so be sure to check back next week. In the meantime check out Coaching Call Week 15; it's new! It's quite a read (so much for my new short-post policy) and is only back-dated for timeline consistency.

Here's the quick list of my current open positions:

Shorts:

SVN - opened on 10/9 for $6.73; unrealized gain: +2.6%

CRDN - opened on 10/10 for $41.75; unrealized gain: +0.7%

MO - opened on 10/10 for $77.97; unrealized gain: -1.1%

The Altria (MO) trade is a bit experimental and one I'm playing with only for paper trade study. This isn't one that I'd enter with my live account quite yet. Some justification seems in order, no? Well I was interpreting an Island reversal pattern with a bit of a head-and-shoulders thrown in. My read of reversal patterns isn't really strong yet, so I'm using this trade as a study, hence why I'd only do this with my paper trading account until I have reasonable results over the long-term for similar plays. The good news is that I did nail the initial direction and just didn't see enough of a gain to adjust my stop and lock in the profits from yesterday's decline. I'm not out of this trade yet, though I did scale out half of my position as a way to reduce the possible loss. Tomorrow will tell if today's gains can be erased and I can possibly see some profit. These aggressive bulls need to rest sometime!

Longs:

ALL - opened on 10/11 for $62.52; unrealized gain: -0.35%

JNJ - opened on 10/11 for $65.09; unrealized gain: 0%

Here's the quick list of my current open positions:

Shorts:

SVN - opened on 10/9 for $6.73; unrealized gain: +2.6%

CRDN - opened on 10/10 for $41.75; unrealized gain: +0.7%

MO - opened on 10/10 for $77.97; unrealized gain: -1.1%

The Altria (MO) trade is a bit experimental and one I'm playing with only for paper trade study. This isn't one that I'd enter with my live account quite yet. Some justification seems in order, no? Well I was interpreting an Island reversal pattern with a bit of a head-and-shoulders thrown in. My read of reversal patterns isn't really strong yet, so I'm using this trade as a study, hence why I'd only do this with my paper trading account until I have reasonable results over the long-term for similar plays. The good news is that I did nail the initial direction and just didn't see enough of a gain to adjust my stop and lock in the profits from yesterday's decline. I'm not out of this trade yet, though I did scale out half of my position as a way to reduce the possible loss. Tomorrow will tell if today's gains can be erased and I can possibly see some profit. These aggressive bulls need to rest sometime!

Longs:

ALL - opened on 10/11 for $62.52; unrealized gain: -0.35%

JNJ - opened on 10/11 for $65.09; unrealized gain: 0%

Tuesday, October 10, 2006

Re: Mark I like your BLOG! - Trade Seeker Question

On 10/7/06, TG wrote:

Hi, thank you for your compliments on my blog, I'm glad you're finding it interesting. It seems that all indicators are almost always lagging and give the signal late. I focus heavily on the source of those indicators: the price action. I look at what institutions are doing and volume characteristics for confirmation. I also prefer to see the Stochastics hitting stronger peaks or valleys on the previous swing highs or lows. I glance at Chaikin Money Flow, but it generally only reflects the price action and doesn't offer much actual insight into where the stock is going. I look at the broad market charts to help me determine if I should be selling, because the market is at retail price, or buying because it's at wholesale price. The broad market charts factor in heavily to individual stock price movement. I also look at where the stock is on it's weekly chart (retail or wholesale) as that time-frame also helps determine how likely the expected move may be.

There are various strategies and approaches to trading. The one thing that I completely understand at this point is that you must have a trading plan and you must trade the plan. Having a system will give you consistent results. If the results are consistently bad, then the system must be tuned. Emotions are a battle, one that I think I'm gaining control of. Even though my trades have been virtual trades, I'm mentally coming from a position of "that's my money!" and although I don't think the pain on the losses is quite the same on paper trades, it is with the intention of using real money that I practice systematic trading.

All systems must be evaluated based on current market conditions and this is where black-box systems will all eventually fail. The hard part is that just about when you think you've found a really great system to rely on, the market changes enough to cause your system to no longer be as valid. I know, it seems like a contradiction in and of itself, but one thing in your system must incorporate is the idea that "anything can happen" and you should be prepared for anything. Playing both sides of the market, keeping your cool when others are panicking (read: systematic approach) and having the patience to enter the trade you want -- not feeling the urgency to place trades just for the thrill of doing so. Patience, discipline, and a consistently calm approach with a plan will do wonders.

With all that said: part of the reason you've been having trouble figuring out what system I've been using is that I've been a bit inconsistent. My exits are based on price-action. If the trade has made the initially anticipated move, then I'm likely to put a reasonably tight trailing-stop. I'll definitely do this if I think I'm seeing an exhaustion gap. Also, on extended range candles I'll look for some sort of intraday support or resistance to set my stop. Exiting is something that I let the market do for me, when the trade is showing signs of weakness.

Now, for your question about Trade Seeker. I don't know what scans are available on StockCharts.com. I just now took a quick glance to not have to speak to something I know nothing about :-P. I find Trade Seeker to be very easy to use, especially in combination with The Trade Center, since it flows the symbols over into The Trade Center software and I find it very easy to sort, scan and otherwise go through a list of thousands of charts a week (> 100 every night and more on the weekends). I'll probably end up settling down on my watchlist maintenance routines eventually as I get better at everything. It seems StockCharts.com has some good things going and I think the custom scans could probably be used to emulate Trade Seeker's built-in facilities. I really do like Trade Seeker, and it is the source of my watchlist (of course I filter it down from the original scans).

Hi Mark,It looks like we are all learning the same way, through a bit of study and trial & error. I really enjoy your posts!I recently took the TMTT 3 day class and learned about the use of technical indicators and TMTT philosophy of not making a trade until 3+ "high probability indicators" signal getting into a position. In looking at some of your trades, I am not sure I have been able to discern your signals to get in or out based on the technicals, but I do see you using the technicals to set up your stops. Do you use the 3+ high probability indicator approach?Also on that note, do you use the "Trade Seeker" software? Is it worth the purchase price or can i get as much using say stockcharts.com's scans?Just would ejoy another enthusiast's thoughts!Hey, keep on having fun and best of luck in your trading!Regards,T

Hi, thank you for your compliments on my blog, I'm glad you're finding it interesting. It seems that all indicators are almost always lagging and give the signal late. I focus heavily on the source of those indicators: the price action. I look at what institutions are doing and volume characteristics for confirmation. I also prefer to see the Stochastics hitting stronger peaks or valleys on the previous swing highs or lows. I glance at Chaikin Money Flow, but it generally only reflects the price action and doesn't offer much actual insight into where the stock is going. I look at the broad market charts to help me determine if I should be selling, because the market is at retail price, or buying because it's at wholesale price. The broad market charts factor in heavily to individual stock price movement. I also look at where the stock is on it's weekly chart (retail or wholesale) as that time-frame also helps determine how likely the expected move may be.

There are various strategies and approaches to trading. The one thing that I completely understand at this point is that you must have a trading plan and you must trade the plan. Having a system will give you consistent results. If the results are consistently bad, then the system must be tuned. Emotions are a battle, one that I think I'm gaining control of. Even though my trades have been virtual trades, I'm mentally coming from a position of "that's my money!" and although I don't think the pain on the losses is quite the same on paper trades, it is with the intention of using real money that I practice systematic trading.

All systems must be evaluated based on current market conditions and this is where black-box systems will all eventually fail. The hard part is that just about when you think you've found a really great system to rely on, the market changes enough to cause your system to no longer be as valid. I know, it seems like a contradiction in and of itself, but one thing in your system must incorporate is the idea that "anything can happen" and you should be prepared for anything. Playing both sides of the market, keeping your cool when others are panicking (read: systematic approach) and having the patience to enter the trade you want -- not feeling the urgency to place trades just for the thrill of doing so. Patience, discipline, and a consistently calm approach with a plan will do wonders.

With all that said: part of the reason you've been having trouble figuring out what system I've been using is that I've been a bit inconsistent. My exits are based on price-action. If the trade has made the initially anticipated move, then I'm likely to put a reasonably tight trailing-stop. I'll definitely do this if I think I'm seeing an exhaustion gap. Also, on extended range candles I'll look for some sort of intraday support or resistance to set my stop. Exiting is something that I let the market do for me, when the trade is showing signs of weakness.

Now, for your question about Trade Seeker. I don't know what scans are available on StockCharts.com. I just now took a quick glance to not have to speak to something I know nothing about :-P. I find Trade Seeker to be very easy to use, especially in combination with The Trade Center, since it flows the symbols over into The Trade Center software and I find it very easy to sort, scan and otherwise go through a list of thousands of charts a week (> 100 every night and more on the weekends). I'll probably end up settling down on my watchlist maintenance routines eventually as I get better at everything. It seems StockCharts.com has some good things going and I think the custom scans could probably be used to emulate Trade Seeker's built-in facilities. I really do like Trade Seeker, and it is the source of my watchlist (of course I filter it down from the original scans).

Monday, October 09, 2006

Coaching Hotline Call Re: Short Sale

Curtis from the TMTT called me back today after I left a message on the coaching hotline. The question I left on the hotline was essentially: I've received the following message: "XYZ stock is not available for short sale." What's up with that? (BTW the two that I've received this message for are: NURO & NTES).

The answer is in the error message, thems the rules. Apparently there can be a variety of reasons and I should talk to my brokerage firm about finding a way to display the status of whether or not the stock is available for short sale. Curtis also clued me in that there are some stocks that only allow certain amounts or percentage of margin, with some stocks that can't be traded using margin at all.

With that answer we kind of flowed into a couple other questions that have been on my mind. One was about stocks gaping at opening, how and when do I know if a stock is going to gap at opening? The answer is simple enough. If the Bid & Ask straddle the last price, there's no gap at open. The question about when is a bit more difficult. There's both post- and pre-market trading that can affect the opening price based on news reports, etc... Because of pre-market trading, the only time you can really know is just before market open. I'm interested in managing open positions that gap against me, not in playing gaps at this point in time. I am aware of some gap based strategies, but primarily I'm wanting to see if I can reduce my losses by managing the gap by hand instead of just being stopped out for maximum loss. Gaps do often fill, but not always. Let's take a long position, for example. If I'm going to be stopped out because of a down-gap, what's the harm in setting a new stop just below the opening price? If the gap just continues down then I loose a bit more, but if it begins to fill the gap I can manage the trade by following the swing lows and adjusting my stop to follow the gap being filled in until it shows weakness and goes against me, possibly turning a loser into a winner, or at least take less of a loss. Granted this is a more active management strategy and means I'll need to be in front of the market for such management decisions, but it's a likely management tactic that I will employ when possible.

I then asked about Curtis' trading style and asked how he managed trades. He manages his trades based on the daily chart. Other strategies take more time. Curtis also shared with me that he doesn't really worry about gaps. They're going to happen and they'll either work for him or not. First, they're not that common and it's just part of trading. It's an odds based business and even though those occasional losses may hurt, they won't take you out of the game if you're managing your money properly.

Curtis was also able to field a question I've had about determining the number of option contracts. This has everything to do with money management. His answer is he purchases the number of contracts that will only lose him the amount he's willing to give up. So if he's able to take a $500 loss on any given trade he calculates the number of options that will give him a $500 loss based on the initial stop with the cost of the spread (which is 5 to 20 cents) factored in. That's smart money management. You only risk what you can afford to lose, which could mean that you'll only be trading a handful of option contracts on any given trade.

So we had about a 1/2 hour long conversation which was quite pleasant and I'll be calling the coaching hotline when more questions arise.

The answer is in the error message, thems the rules. Apparently there can be a variety of reasons and I should talk to my brokerage firm about finding a way to display the status of whether or not the stock is available for short sale. Curtis also clued me in that there are some stocks that only allow certain amounts or percentage of margin, with some stocks that can't be traded using margin at all.

With that answer we kind of flowed into a couple other questions that have been on my mind. One was about stocks gaping at opening, how and when do I know if a stock is going to gap at opening? The answer is simple enough. If the Bid & Ask straddle the last price, there's no gap at open. The question about when is a bit more difficult. There's both post- and pre-market trading that can affect the opening price based on news reports, etc... Because of pre-market trading, the only time you can really know is just before market open. I'm interested in managing open positions that gap against me, not in playing gaps at this point in time. I am aware of some gap based strategies, but primarily I'm wanting to see if I can reduce my losses by managing the gap by hand instead of just being stopped out for maximum loss. Gaps do often fill, but not always. Let's take a long position, for example. If I'm going to be stopped out because of a down-gap, what's the harm in setting a new stop just below the opening price? If the gap just continues down then I loose a bit more, but if it begins to fill the gap I can manage the trade by following the swing lows and adjusting my stop to follow the gap being filled in until it shows weakness and goes against me, possibly turning a loser into a winner, or at least take less of a loss. Granted this is a more active management strategy and means I'll need to be in front of the market for such management decisions, but it's a likely management tactic that I will employ when possible.

I then asked about Curtis' trading style and asked how he managed trades. He manages his trades based on the daily chart. Other strategies take more time. Curtis also shared with me that he doesn't really worry about gaps. They're going to happen and they'll either work for him or not. First, they're not that common and it's just part of trading. It's an odds based business and even though those occasional losses may hurt, they won't take you out of the game if you're managing your money properly.

Curtis was also able to field a question I've had about determining the number of option contracts. This has everything to do with money management. His answer is he purchases the number of contracts that will only lose him the amount he's willing to give up. So if he's able to take a $500 loss on any given trade he calculates the number of options that will give him a $500 loss based on the initial stop with the cost of the spread (which is 5 to 20 cents) factored in. That's smart money management. You only risk what you can afford to lose, which could mean that you'll only be trading a handful of option contracts on any given trade.

So we had about a 1/2 hour long conversation which was quite pleasant and I'll be calling the coaching hotline when more questions arise.

Bulls Poor In Money

Buried in my last posting was "... I'm not underestimating the bulls optimism as they've been pushing the market up ..." And how! Although I'm a bit perplexed I'm not going to argue with this trend. I am going to use my money wisely. With the markets sitting pretty at retail pricing, I'm more interested in stocks that I can sell short for retail and then buy back at wholesale. Fortunately, my diligence in maintaining my watchlist is serving me well and I have several down trending stocks that are setting up nicely. I'm sitting on the sidelines and am waiting for them to show signs of weakness for me to profit from their decline as the markets finally find a point to pullback and see some profit taking. With the markets putting in narrow-range candles that are showing some resistance, today could be that changing of the guard and we can reasonably expect some profit-taking at least.

Currently I have 2 open positions: long on MET and short on SVN.

I'm known for monstrously long postings. I'm thinking about changing that up a little in order to bring you more frequent content. Now that classes and coaching calls are nearly complete, with only one more scheduled coaching call this Wednesday, I'll be posting mostly about my experience in the rough-and-tumble markets. I'll do what I can to keep it entertaining, even if only for you to find amusement in my folly.

... and yes, the title of this posting is a pun, I hope you don't mind ;-)

Currently I have 2 open positions: long on MET and short on SVN.

I'm known for monstrously long postings. I'm thinking about changing that up a little in order to bring you more frequent content. Now that classes and coaching calls are nearly complete, with only one more scheduled coaching call this Wednesday, I'll be posting mostly about my experience in the rough-and-tumble markets. I'll do what I can to keep it entertaining, even if only for you to find amusement in my folly.

... and yes, the title of this posting is a pun, I hope you don't mind ;-)

Wednesday, October 04, 2006

Coaching Call Week 15

Just before Rob's weekly call I opened a position on MET. This was a classic swing entry following all of my rules and I triggered the entry manually by watching the intraday chart. It just happens that I caught a pullback that was 1 cent above the previous day's high. There was a deeper pullback later, but I was complimented on this being a good trade that followed my trading rules. In general, coach Rob was pleased with what he was hearing as I described the few open positions and trades that executed over the past week.

I was stopped out of my short position on TTI in a weird way. It seems I entered a bad stop-loss and bought it back for a very nice ~7% gain. I'm not really complaining, because that's a killer return in 2 days, but I would have squeezed nearly a percent more if I didn't accidentally violate my own management rules. We reviewed what happened there followed by other open positions and how they closed out.

I expressed some regret about not entering a trade yesterday on LNC, which had a very nice pullback and at this time it was going up very nicely. Coach Rob wasn't pleased with the emotion I was expressing on missing this trade on LNC. I can appreciate this, since there will always be missed trades and there's just no reason to be bothered by missed opportunities. The reason I didn't enter that position is that I was totally exhausted on Monday night. In retrospect I think I did the right thing by not trying to make such judgements when I'm unable to focus because of lack of sleep. I saw the direction, realized it was probably a good trade to enter and I was right. Cool. The fact that I didn't risk the entry under such a weakened mental state is probably a good thing. This is akin to not shopping or playing poker online after having a few drinks, no?

As pleased as Rob was with my progress, he remarked that that I was showing him the trades I wanted to show him. I quickly offered to show him the ones that went against me, started to pull up OSI & CEI, and he had a little chuckle.

After this run-thru of my current positions, coach Rob spent some time talking about Options. As you probably know from my previous posts, Rob is very knowledgeable with trading Options. The primary reason I'm focused on stocks is to reduce the complexity and practice all the good habits of a Professional Trader without having to deal with the additional complexities involved with Options. Options offer a lot of leverage, and good trading practices are essential in order to not have your account decimated by that very same leverage. Remember, the Bid-Ask spread insight I've offered in the past? When your trades come with a 5%-15% built-in loss, you better have your timing and discipline well honed.

Coach Rob covered how a Trader can leg out of an Option Spread depending on your outlook for a particular stock. He also went on to describe a way to aid in timing entry and exit based on the behavior of the Bid & Ask on a specific Option Contract. I'd describe it to you here, but why not sign up for coaching with Rob and get it directly from him? Tell him Mark sent ya! ;-) I can tell you that all such strategies are judgement calls and this is just another source of information to help you determine timing.

Before wrapping up this post I want to give credit where credit is due. Rob Craig has been a tremendous help in bridging the gap between the theory of trading taught in the classes to the actual practical application of that knowledge. My rapid progress is due in large part to the personal attention and feedback. If any of you are entering the Teach Me To Trade or Star Trader coaching program, I highly recommend asking specifically for Rob Craig. I inadvertently stole (or maybe borrowed) Rob's saying and titled a post last month based on it: Discipline, Patience & Timing! This was something that Rob ingrained in me right from the beginning and I didn't even realize I was quoting him when I titled my post as I did. Most of the practices and habits that I've formed have been forged out of Rob's guidance and I'm confident that if I consistently put all these practices together, I will be a successful professional trader.

I was stopped out of my short position on TTI in a weird way. It seems I entered a bad stop-loss and bought it back for a very nice ~7% gain. I'm not really complaining, because that's a killer return in 2 days, but I would have squeezed nearly a percent more if I didn't accidentally violate my own management rules. We reviewed what happened there followed by other open positions and how they closed out.

I expressed some regret about not entering a trade yesterday on LNC, which had a very nice pullback and at this time it was going up very nicely. Coach Rob wasn't pleased with the emotion I was expressing on missing this trade on LNC. I can appreciate this, since there will always be missed trades and there's just no reason to be bothered by missed opportunities. The reason I didn't enter that position is that I was totally exhausted on Monday night. In retrospect I think I did the right thing by not trying to make such judgements when I'm unable to focus because of lack of sleep. I saw the direction, realized it was probably a good trade to enter and I was right. Cool. The fact that I didn't risk the entry under such a weakened mental state is probably a good thing. This is akin to not shopping or playing poker online after having a few drinks, no?

As pleased as Rob was with my progress, he remarked that that I was showing him the trades I wanted to show him. I quickly offered to show him the ones that went against me, started to pull up OSI & CEI, and he had a little chuckle.

After this run-thru of my current positions, coach Rob spent some time talking about Options. As you probably know from my previous posts, Rob is very knowledgeable with trading Options. The primary reason I'm focused on stocks is to reduce the complexity and practice all the good habits of a Professional Trader without having to deal with the additional complexities involved with Options. Options offer a lot of leverage, and good trading practices are essential in order to not have your account decimated by that very same leverage. Remember, the Bid-Ask spread insight I've offered in the past? When your trades come with a 5%-15% built-in loss, you better have your timing and discipline well honed.

Coach Rob covered how a Trader can leg out of an Option Spread depending on your outlook for a particular stock. He also went on to describe a way to aid in timing entry and exit based on the behavior of the Bid & Ask on a specific Option Contract. I'd describe it to you here, but why not sign up for coaching with Rob and get it directly from him? Tell him Mark sent ya! ;-) I can tell you that all such strategies are judgement calls and this is just another source of information to help you determine timing.

Before wrapping up this post I want to give credit where credit is due. Rob Craig has been a tremendous help in bridging the gap between the theory of trading taught in the classes to the actual practical application of that knowledge. My rapid progress is due in large part to the personal attention and feedback. If any of you are entering the Teach Me To Trade or Star Trader coaching program, I highly recommend asking specifically for Rob Craig. I inadvertently stole (or maybe borrowed) Rob's saying and titled a post last month based on it: Discipline, Patience & Timing! This was something that Rob ingrained in me right from the beginning and I didn't even realize I was quoting him when I titled my post as I did. Most of the practices and habits that I've formed have been forged out of Rob's guidance and I'm confident that if I consistently put all these practices together, I will be a successful professional trader.

Monday, October 02, 2006

Market Study for 2006-10-02

Happy Monday to all! You may be wondering: why would Mark consider this to be a happy Monday with the market selling off today? I'm happy because I closed out most of my long positions for some reasonable profits last week and have since opened 3 short positions that seem to be developing nicely (virtual trades still, mind you). I've also been holding a long position on GM (bought @ $31.20 on 9/26 : +7.35%) and reentered a position on AT&T that isn't moving my direction yet (bought @ $32.45 on 9/26, current gains: -0.75%), but still looks good and it doesn't seem to be overly likely that I'll get stopped out.

The short positions I opened today (10/02) are: OII ($30.26 : -0.55%), JOYG ($36.86 : +0.96%), TTI ($23.82 : +3.2%). We'll see how these develop soon enough...

Bad News: lost ~2% on both OSI and CEI which leads me to a new idea of not entering long positions on 3 letter stocks that end in I. I'm pretty sure that will keep me out of trouble in the future ;-). OSI faked me out and CEI had great Institutional buy-in interest, but the price just wouldn't budge up. It dropped low enough today to trigger my entry stop-loss and well, I'm out of the trade. At this point CEI looks like it's not going anywhere for a little while anyway.

Good News: gained enough on LNC, T, NAV and AMAT to be net positive, even after those drawdowns. Of course GM should contribute to that net positive when I'm ready to close it out. Isn't that how trading is supposed to work?

I've been predicting doom & gloom for the markets for the past 3 trading days. Well, maybe not doom & gloom, but it seemed like the market was due for a pullback. If you read my blog last week you'd know that I was a couple days early to the punch. As expected, the markets have seen a correction for the last couple days, but I'm not underestimating the bulls optimism as they've been pushing the market up until the bears finally held their ground on Friday and exerted some downward pressure today. There is a great deal of market optimism, but it seems to be a bit too shallow to support the last buying frenzy.

I've been keeping a keen eye for good bearish trades and had a plethora to choose from last night. I saw about a dozen Reward:Risk ratios of > 3:1 in my bears watchlist last night and cut it down to 5 that I flipped a coin on and decided to attempt entry today. As described earlier, 3 filled (the two that didn't were CMC &GGB, I'll reevaluate those two tonight). Two that I didn't attempt entry on, but made a very nice move down today are: HES and HP.

This post is titled Market Study for today so let's go on with the show, shall we?

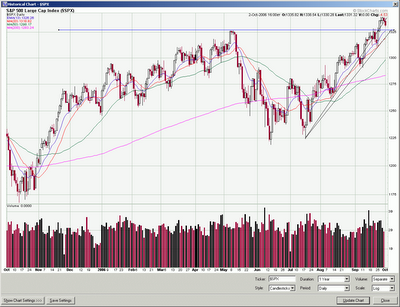

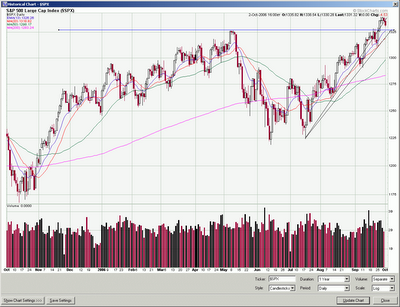

The S&P 500 seems straight-forward enough, it looks likely to pullback to near the previous high or at least consolidate near it's closing value today.

The Dow-Jones Industrial Average seems to have been a bit more practical in it's last swing high, but still looks like it could close below it's previous high for the next couple days.

Everybody loves the NASDAQ right? There's plenty of optimism and fresh money that can be thrown into technology stocks to drive the NASDAQ up. Why do I say this? CNBC watchers have been told that money is being pulled out of energy stocks and is being put into the technology stocks. Of course that begs the question: are people so easily herded? Possibly, but of course, like any entity forecasting market direction, it's done with the other side presenting an equally convoluted case for why the market could likely go the other way. It's a fun game of semantics and opinion. So rather than speculating based on sentiment, let's read the story that the price-action (aka: mass-psychology) is telling. Considering the previous price-action that I've highlighted, we could certainly see some consolidation and volatility as it stumbles it's way up.

As always, form your own opinions and have a good laugh at me for sticking my neck out there and actually favoring a direction. Please remember that I'm an aspiring professional and I still consider my technical analysis skills in their infancy. I think we're in for some volatility more than direction for a while which is pretty good news for playing both sides of the market at the same time, although that does mean that you can get burned either way, right?

Thank you for your continued interest in my blog! Don't take what I write too seriously, I've been wrong before and I'll be wrong again!

The short positions I opened today (10/02) are: OII ($30.26 : -0.55%), JOYG ($36.86 : +0.96%), TTI ($23.82 : +3.2%). We'll see how these develop soon enough...

Bad News: lost ~2% on both OSI and CEI which leads me to a new idea of not entering long positions on 3 letter stocks that end in I. I'm pretty sure that will keep me out of trouble in the future ;-). OSI faked me out and CEI had great Institutional buy-in interest, but the price just wouldn't budge up. It dropped low enough today to trigger my entry stop-loss and well, I'm out of the trade. At this point CEI looks like it's not going anywhere for a little while anyway.

Good News: gained enough on LNC, T, NAV and AMAT to be net positive, even after those drawdowns. Of course GM should contribute to that net positive when I'm ready to close it out. Isn't that how trading is supposed to work?

I've been predicting doom & gloom for the markets for the past 3 trading days. Well, maybe not doom & gloom, but it seemed like the market was due for a pullback. If you read my blog last week you'd know that I was a couple days early to the punch. As expected, the markets have seen a correction for the last couple days, but I'm not underestimating the bulls optimism as they've been pushing the market up until the bears finally held their ground on Friday and exerted some downward pressure today. There is a great deal of market optimism, but it seems to be a bit too shallow to support the last buying frenzy.

I've been keeping a keen eye for good bearish trades and had a plethora to choose from last night. I saw about a dozen Reward:Risk ratios of > 3:1 in my bears watchlist last night and cut it down to 5 that I flipped a coin on and decided to attempt entry today. As described earlier, 3 filled (the two that didn't were CMC &GGB, I'll reevaluate those two tonight). Two that I didn't attempt entry on, but made a very nice move down today are: HES and HP.

This post is titled Market Study for today so let's go on with the show, shall we?

The S&P 500 seems straight-forward enough, it looks likely to pullback to near the previous high or at least consolidate near it's closing value today.

The Dow-Jones Industrial Average seems to have been a bit more practical in it's last swing high, but still looks like it could close below it's previous high for the next couple days.

Everybody loves the NASDAQ right? There's plenty of optimism and fresh money that can be thrown into technology stocks to drive the NASDAQ up. Why do I say this? CNBC watchers have been told that money is being pulled out of energy stocks and is being put into the technology stocks. Of course that begs the question: are people so easily herded? Possibly, but of course, like any entity forecasting market direction, it's done with the other side presenting an equally convoluted case for why the market could likely go the other way. It's a fun game of semantics and opinion. So rather than speculating based on sentiment, let's read the story that the price-action (aka: mass-psychology) is telling. Considering the previous price-action that I've highlighted, we could certainly see some consolidation and volatility as it stumbles it's way up.

As always, form your own opinions and have a good laugh at me for sticking my neck out there and actually favoring a direction. Please remember that I'm an aspiring professional and I still consider my technical analysis skills in their infancy. I think we're in for some volatility more than direction for a while which is pretty good news for playing both sides of the market at the same time, although that does mean that you can get burned either way, right?

Thank you for your continued interest in my blog! Don't take what I write too seriously, I've been wrong before and I'll be wrong again!

Coaching Call Week 14

I greeted coach Rob (as I've taken to referring to him in my blog) with the statement: Rob, I have a problem... Oh? ... Yes, I have several trades that are working for me! Granted this is a very good problem to have, but it is a problem none-the-less. I had 5 trades going my way and 1 that was just doing so-so, which was probably going to go against me for a loss. Of course this is the kind of problem you want to have, but I don't have much experience with. We looked at how to manage these positions which for the most part was to just relax and update my stop position when the trades had moved enough to warrant it.

We got to narrow our focus in on a couple trades. First I wanted his feedback on my short-sale of ROK, which I was kicked out of yesterday. Basically what I did wasn't wrong, though I could have tightened a little or even bought back half of my position as the stock came very close to the move that I wanted, but aside from some institutional buying at the end of the day on Monday and a speculatively positive news item, there wasn't much that could have been done to make this trade much better.

We watched T fall down to my stop and see me get kicked out of the trade. This was fine, though once again I could see the trend on the daily chart and probably could have just closed the position earlier to realize a better gain. This was educational though as I could see the value of Technical Analysis on a different time scale.

That's one great argument for Technical Analysis. Since it's a study of mass psychology and sentiment, you can make judgements based on what the chart tells you no matter the time frame nor the underlying security (though I don't plan to trade futures nor commodities anytime soon). We could both see that T was in a downtrend on the intraday chart and I really should have exited my long position earlier and just taken the my profits. I'm not upset about it, but it does bring to light that the trade management rules need to be as mechanical as the entry rules. This has been easy enough when I was dealing with losses, but on these trades that actually went my way, I realize I need to have a consistent method for managing the trade.

We got to narrow our focus in on a couple trades. First I wanted his feedback on my short-sale of ROK, which I was kicked out of yesterday. Basically what I did wasn't wrong, though I could have tightened a little or even bought back half of my position as the stock came very close to the move that I wanted, but aside from some institutional buying at the end of the day on Monday and a speculatively positive news item, there wasn't much that could have been done to make this trade much better.

We watched T fall down to my stop and see me get kicked out of the trade. This was fine, though once again I could see the trend on the daily chart and probably could have just closed the position earlier to realize a better gain. This was educational though as I could see the value of Technical Analysis on a different time scale.

That's one great argument for Technical Analysis. Since it's a study of mass psychology and sentiment, you can make judgements based on what the chart tells you no matter the time frame nor the underlying security (though I don't plan to trade futures nor commodities anytime soon). We could both see that T was in a downtrend on the intraday chart and I really should have exited my long position earlier and just taken the my profits. I'm not upset about it, but it does bring to light that the trade management rules need to be as mechanical as the entry rules. This has been easy enough when I was dealing with losses, but on these trades that actually went my way, I realize I need to have a consistent method for managing the trade.

Tuesday, September 26, 2006

ROK Changed It's Mind

So, I think it was yesterday that I said I don't think ROK was strong enough to sustain itself above $55... And then it closed at $55.13 and I was stopped out of my position when it breached my stop that was set at the 2 days ago prior high. Of course today ROK gained 2% and I bought my short sale ($57.57) back for $55.60. A 3.3% gain (adjusted for Cost of Trade) over 7 trading days. I'm not one to argue with the market, and I'll happily take my 3.3% gain and say thank you, however...

I could have got more like a 5% gain if I interpreted the news headline: "Rockwell Automation to Present at Prudential Conference" as positive news that other traders and investors would want to buy ROK based on the results of that conference presentation. Combine that with the narrow range candle (almost a Doji) on Friday that could have been interpreted as an exhaustion gap (the % distance of the gap wasn't quite enough for me to jump ship) and I could have exited earlier. I stuck to my trading rules though because none of that had quite enough certainty. Based on the information I had, I decided that I'd leave it some wiggle room to hopefully let the trade develop a little further before tightening up my stop. I do want to review this with coach Rob and see what he thinks of how I handled it and accept any criticism offered.

In other news, I have a problem of my open trades working for me. It's a good problem to have, but I don't have quite as much experience managing the trades when they're working for me! I have 6 open positions (LNC +1.5%, T +5.4%, AMAT +2.3%, NAV +3.54%, GM +0.7%, OSI -0.4%). As you can see, this is a very good problem to have, but knowing that the markets are a bit overbought and we're more likely to see some profit taking than not tomorrow has me a little twitchy on these long positions. I'm going to follow the rules in managing these, but may tighten and get out on early signs of sell-off in order to actually lock in those profits. Stay tuned, it's just beginning to get interesting!

I could have got more like a 5% gain if I interpreted the news headline: "Rockwell Automation to Present at Prudential Conference" as positive news that other traders and investors would want to buy ROK based on the results of that conference presentation. Combine that with the narrow range candle (almost a Doji) on Friday that could have been interpreted as an exhaustion gap (the % distance of the gap wasn't quite enough for me to jump ship) and I could have exited earlier. I stuck to my trading rules though because none of that had quite enough certainty. Based on the information I had, I decided that I'd leave it some wiggle room to hopefully let the trade develop a little further before tightening up my stop. I do want to review this with coach Rob and see what he thinks of how I handled it and accept any criticism offered.

In other news, I have a problem of my open trades working for me. It's a good problem to have, but I don't have quite as much experience managing the trades when they're working for me! I have 6 open positions (LNC +1.5%, T +5.4%, AMAT +2.3%, NAV +3.54%, GM +0.7%, OSI -0.4%). As you can see, this is a very good problem to have, but knowing that the markets are a bit overbought and we're more likely to see some profit taking than not tomorrow has me a little twitchy on these long positions. I'm going to follow the rules in managing these, but may tighten and get out on early signs of sell-off in order to actually lock in those profits. Stay tuned, it's just beginning to get interesting!

Monday, September 25, 2006

Current Positions Update 2006-09-25

It seems I must have dumped my AT&T Option early. it's now worth $1.70 (240% return) which is way more than a mere 150% return. Does this bother me? Not really, I'm only dabbling with Options at the moment. I still have the stock and it's gained over 6% for me (in 4 days). Stocks are my primary focus for now.